The Ultimate Guide To Tax Accountant In Vancouver, Bc

Wiki Article

The Ultimate Guide To Small Business Accountant Vancouver

Table of ContentsGet This Report about Pivot Advantage Accounting And Advisory Inc. In VancouverThe Best Strategy To Use For Outsourced Cfo ServicesAll About Small Business Accounting Service In VancouverFacts About Vancouver Accounting Firm Uncovered

Due to the fact that it's their work to stay up to day with tax codes and also policies, they'll have the ability to recommend you on how much money your service requires to deposit so there aren't any type of shocks. Prior to you go crazy an audit isn't always negative! The dreaded "internal revenue service audit" happens when an organization isn't filing their taxes properly.

When it concerns planning for any kind of audit, your accountant can be your buddy since they'll save you loads of time preparing for the audit. To stop your organization from obtaining "the bad audit", right here are some suggestions to comply with: File as well as pay your tax obligations promptly Do not improperly (or forget to) documents organization sales and also receipts Don't report individual costs as company expenditures Maintain precise business documents Know your particular business tax obligation reporting responsibilities Suggested reading: The 8 Most Common Tax Audit Sets Off Quick, Books After reviewing the standard audit as well as accounting services, you're probably wondering whether it's something you can manage on your own or need to hand off to a specialist.

For circumstances, will you need to prepare weekly or regular monthly financial reports or quarterly as well as annual reports? Another point to think about is monetary understanding. Exists somebody in your workplace who is qualified to deal with essential bookkeeping and bookkeeping solutions? Otherwise, an accounting professional may be your most safe wager.

Accountants are fairly versatile as well as can be paid per hour. On top of that, if you do decide to contract out accounting and also accounting services, you would not be accountable for providing benefits like you would for an internal staff member. If you determine to hire an accounting professional or accountant, right here are a couple of suggestions on locating the right one: Check referrals and also previous experience Make sure the candidate is enlightened in accounting software program and technology See to it the candidate is proficient in accounting plans and also treatments Evaluate that the candidate can clearly connect economic language in words you understand Make certain the candidate is sociable as well as not a robotic Tiny organization proprietors as well as entrepreneurs typically outsource accountancy and also accounting services.

Everything about Vancouver Tax Accounting Company

We contrast the very best here: Swing vs. Zoho vs. Quick, Books Do not fail to remember to download our Financial Terms Rip Off Sheet, that includes important bookkeeping and bookkeeping terms.

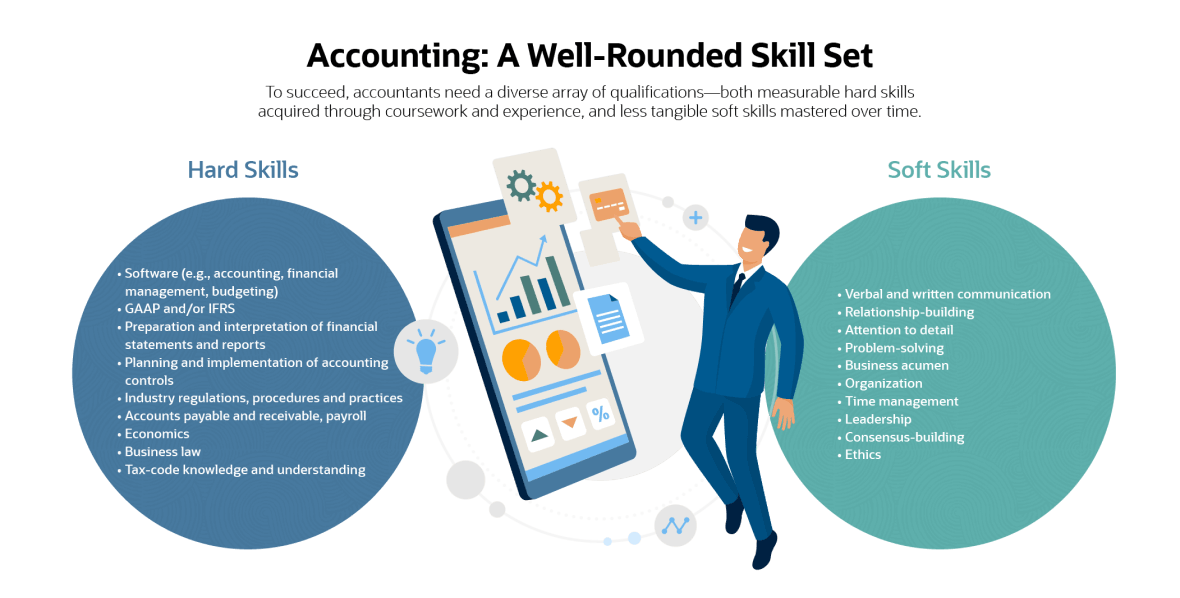

To be successful in this role, you need to have previous experience with bookkeeping and also look at this web-site a panache for spotting mathematical errors. Eventually, you will certainly give us with precise measurable information on economic position, liquidity and also capital of our organization, while guaranteeing we're certified with all tax policies. Handle all accountancy transactions Prepare budget plan forecasts Release economic declarations in time Take care of monthly, quarterly and yearly closings Reconcile accounts payable as well as receivable Ensure timely financial institution settlements Calculate tax obligations and also prepare income tax return Manage balance sheets and also profit/loss declarations Report on the firm's economic health and wellness as well as liquidity Audit monetary transactions and files Strengthen financial data privacy as well as conduct data source back-ups when required Adhere to monetary policies and regulations Function experience as an Accountant Outstanding understanding of accountancy policies as well as procedures, consisting of the Typically Accepted Accountancy Concepts (GAAP) Hands-on experience with accounting software program like Fresh, Books as well as Quick, Books Advanced MS Excel abilities including Vlookups and also pivot tables Experience with general journal functions Solid attention to information and also good analytical abilities BSc in Audit, Financing Read Full Report or pertinent level Additional qualification (certified public accountant or CMA) is a plus What does an Accounting professional do? An Accounting professional looks after all financial matters within a business, like keeping and analyzing financial records - Pivot Advantage Accounting and Advisory Inc. in Vancouver.

The obligations of an Accounting professional can be fairly extensive, from bookkeeping economic documents as well as performing financial audits to resolving financial institution statements as well as determining taxes when loading out annual returns. What makes a great Accounting professional?

Who does Accounting professional function with? Accountants collaborate with company leaders in tiny companies or with supervisors in big corporations to make certain the quality of their economic records. Accounting professionals may likewise collaborate with private group leaders to fetch and examine monetary documents throughout the year.

Unknown Facts About Small Business Accounting Service In Vancouver

The term bookkeeping is really typical, especially throughout tax obligation season. Before we dive into the relevance of accountancy in company, let's cover the essentials what is internet accounting? Accountancy refers to the methodical and thorough recording of monetary transactions of an organization. There are numerous kinds, from accounting for small companies, government, forensic, as well as management accountancy, to accounting for corporations.

Legislations and also laws differ from state to state, however correct bookkeeping systems and also procedures will assist you make sure legal conformity when it pertains to your company (small business accountant Vancouver). The bookkeeping feature will guarantee that obligations such as sales tax obligation, BARREL, revenue tax, and pension funds, to call a couple of, are appropriately attended to.

Company trends as well as projections are based on historic monetary data to maintain your operations profitable. Organizations are called for to file their economic declarations with the Registrar of Companies.

The smart Trick of Cfo Company Vancouver That Nobody is Discussing

Report this wiki page